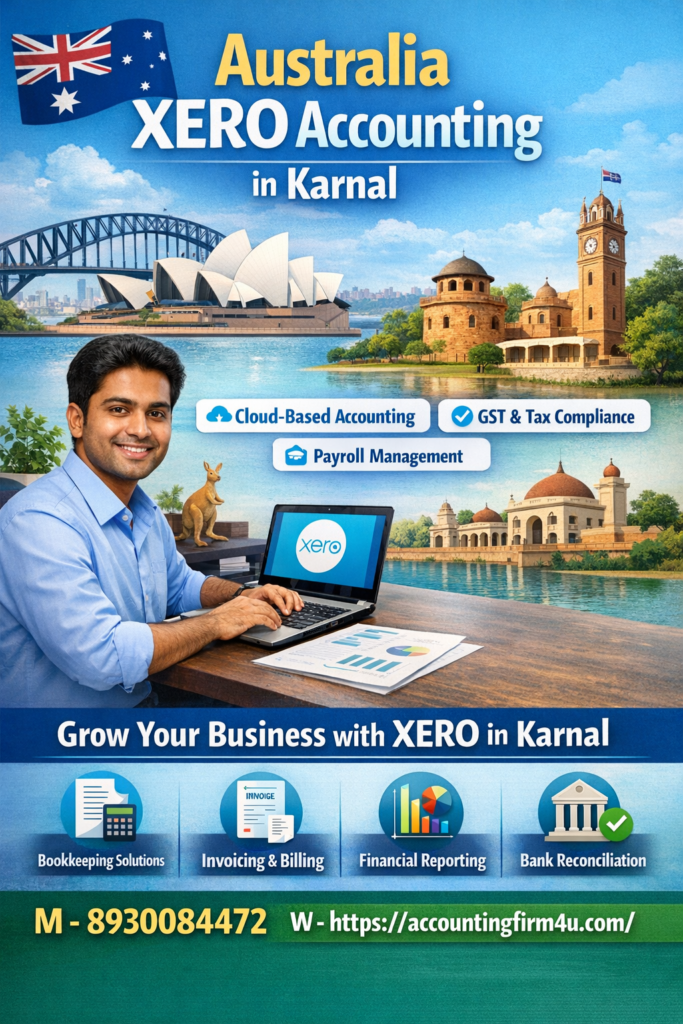

In today’s globalized economy, businesses are no longer limited by geography. Australian companies increasingly outsource accounting and bookkeeping services to reliable international partners to reduce costs, improve efficiency, and access skilled professionals. One of the fastest-growing trends in this space is Australia XERO Accounting in Karnal. Karnal, a developing business hub in Haryana, India, has emerged as a preferred destination for providing specialized XERO accounting services tailored to Australian businesses.

This comprehensive guide explores why Australia XERO Accounting in Karnal is gaining popularity, how XERO supports Australian compliance, and why Karnal-based accounting professionals are trusted by global clients.

Understanding XERO Accounting Software

XERO is a powerful cloud-based accounting software widely used by small and medium-sized businesses across Australia. It offers real-time financial visibility, seamless bank reconciliation, automated invoicing, payroll integration, and compliance-ready reporting.

Key features of XERO include:

- Cloud-based access from anywhere

- Automated bank feeds and reconciliation

- BAS and GST-friendly reporting

- Real-time financial dashboards

- Integration with over 1,000 business apps

Because XERO complies with Australian accounting standards and taxation requirements, it has become the preferred accounting platform for Australian SMEs, startups, and professional firms.

Why Australian Businesses Choose XERO Accounting Services

Australian businesses operate in a highly regulated environment with strict reporting and compliance standards. XERO simplifies these requirements by automating many accounting processes.

Benefits of XERO accounting for Australian companies include:

- Accurate GST tracking and BAS preparation

- Efficient payroll management aligned with Fair Work regulations

- Real-time collaboration with accountants and bookkeepers

- Reduced manual errors through automation

- Time and cost savings

To maximize these benefits, many Australian companies seek experienced XERO accountants who understand both the software and Australian financial regulations.

Why Outsource Australia XERO Accounting to Karnal?

Outsourcing Australia XERO Accounting in Karnal offers a unique combination of technical expertise, cost efficiency, and global service quality. Karnal has rapidly developed a skilled workforce of accounting professionals trained in international accounting standards and cloud-based platforms like XERO.

1. Skilled XERO-Certified Professionals

Accounting firms in Karnal employ trained and XERO-certified accountants who specialize in Australian bookkeeping and accounting practices. These professionals are well-versed in:

- Australian GST and BAS requirements

- Payroll processing and superannuation

- Accounts payable and receivable management

- Financial reporting and analysis

2. Cost-Effective Accounting Solutions

One of the primary reasons Australian businesses outsource XERO accounting to Karnal is cost efficiency. Compared to hiring in-house staff in Australia, outsourcing to Karnal can reduce accounting costs by up to 50–60% without compromising on quality.

3. Time Zone Advantage

The time difference between Australia and India allows Karnal-based accounting teams to work while Australian businesses sleep. This ensures faster turnaround times, overnight task completion, and improved productivity.

4. Data Security and Confidentiality

Reputed accounting service providers in Karnal follow strict data security protocols, including secure cloud access, non-disclosure agreements, and compliance with international data protection standards.

Services Offered Under Australia XERO Accounting in Karnal

Karnal-based accounting firms provide a wide range of XERO accounting services specifically designed for Australian clients.

Bookkeeping Services

- Daily transaction recording in XERO

- Bank and credit card reconciliation

- Accounts payable and receivable management

- Expense categorization and tracking

BAS and GST Services

- GST calculation and reconciliation

- BAS preparation and review

- Compliance with ATO reporting requirements

- Error identification and correction

Payroll Management

- Payroll processing using XERO Payroll

- Superannuation calculations

- Leave entitlements and awards compliance

- Payslip generation and reporting

Financial Reporting

- Profit and loss statements

- Balance sheets

- Cash flow analysis

- Management reports for decision-making

XERO Setup and Migration

- New XERO account setup

- Migration from MYOB, QuickBooks, or Excel

- Chart of accounts customization

- XERO app integrations

Benefits of Australia XERO Accounting in Karnal for CPAs and Firms

Not only businesses but also Australian CPA firms and accounting practices benefit from outsourcing XERO accounting services to Karnal.

Key advantages include:

- Ability to scale operations without hiring locally

- Reduced workload during peak tax seasons

- Focus on client advisory instead of data entry

- Access to dedicated offshore accounting teams

Karnal-based firms often work as extended teams for Australian CPAs, maintaining brand confidentiality and workflow consistency.

Compliance and Quality Standards

A major concern for Australian businesses outsourcing accounting is compliance. Providers offering Australia XERO Accounting in Karnal follow stringent quality control processes.

These include:

- Adherence to Australian Accounting Standards (AASB)

- Regular internal audits and reviews

- Use of standardized accounting checklists

- Continuous training on ATO updates

This ensures that all financial data processed in Karnal meets Australian regulatory expectations.

Why Karnal Is Emerging as an Accounting Outsourcing Hub

Karnal’s growth as an accounting outsourcing destination is driven by several factors:

- Availability of qualified accountants and commerce graduates

- Lower operational and infrastructure costs

- Improved digital connectivity and cloud adoption

- Increasing exposure to international clients

Unlike overcrowded metro cities, Karnal offers stability, lower attrition rates, and dedicated accounting teams, making it ideal for long-term outsourcing partnerships.

How to Choose the Right Australia XERO Accounting Partner in Karnal

When selecting a service provider for Australia XERO Accounting in Karnal, consider the following factors:

- XERO certification and experience with Australian clients

- Understanding of Australian tax and compliance requirements

- Data security policies and confidentiality measures

- Transparent pricing and service-level agreements

- Strong communication and reporting systems

A reliable partner will act as an extension of your business rather than just a service provider.

Future of Australia XERO Accounting in Karnal

With increasing adoption of cloud accounting and remote work, the demand for Australia XERO Accounting in Karnal is expected to grow significantly. Automation, AI-driven accounting tools, and deeper XERO integrations will further enhance service quality.

Australian businesses looking for scalable, accurate, and cost-effective accounting solutions will continue to rely on skilled professionals from Karnal to manage their XERO accounting needs.

Conclusion

Australia XERO Accounting in Karnal represents a smart and strategic choice for Australian businesses and accounting firms seeking efficiency, accuracy, and cost savings. With access to XERO-certified professionals, strong compliance knowledge, and modern cloud-based systems, Karnal has positioned itself as a reliable global accounting outsourcing destination.

By partnering with the right XERO accounting provider in Karnal, Australian businesses can streamline financial operations, maintain regulatory compliance, and focus on growth with confidence.