In today’s fast-growing business environment, accurate accounting and timely tax compliance are essential for every business, whether small, medium, or large. With digitalization, businesses need skilled accounting professionals who understand Practical Tally Prime, GST Return Filing, TDS Return Filing, and Balance Sheet Preparation. These skills not only support smooth business operations but also ensure complete compliance with Indian tax laws.

This article explains the importance of practical accounting, major features of Tally Prime, and how professionals can efficiently manage GST, TDS, and financial statements with the right knowledge and training.

What is Practical Tally Prime Training?

Tally Prime is one of the most widely used accounting software in India. Practical Tally Prime training focuses on teaching students and professionals how to work on real accounting files, invoices, ledgers, taxation entries, and financial reports. Unlike theoretical learning, practical Tally training prepares learners for real business situations and jobs.

Key Skills Covered in Practical Tally Prime Training:

- Creating and managing company data

- Recording purchase, sales, payment & receipt entries

- GST billing and auto GST calculation

- Preparing GSTR reports (GSTR-1, GSTR-3B)

- Inventory and stock management

- Bank reconciliation

- Profit & Loss and Balance Sheet generation

With practical knowledge, students become job-ready for roles such as accountant, GST executive, tally operator, and junior accounts associate.

Importance of GST Return Filing in Modern Business

The Goods and Services Tax (GST) has simplified the taxation system but also increased the responsibility of businesses to file returns on time. A trained GST professional ensures accurate and timely filing, avoiding penalties and notices.

Types of GST Returns Covered in Practical Training:

- GSTR-1: Monthly/quarterly sales details

- GSTR-3B: Summary return of taxes

- GSTR-9: Annual return

- GSTR-2B: Input tax credit statement

Practical GST return filing teaches:

- Creating GST invoices in Tally Prime

- Adjusting Input Tax Credit (ITC)

- Uploading data on the GST portal

- Matching GSTR reports with books

- Avoiding common GST filing errors

This hands-on training helps professionals work confidently in accounting firms, industries, and tax consultancies.

TDS Return Filing – A Crucial Part of Compliance

TDS (Tax Deducted at Source) is mandatory for various business payments such as salaries, rent, contractor payments, professional fees, interest, etc. Incorrect TDS filing can result in heavy penalties and notices.

Practical TDS Filing Training Includes:

- Understanding TDS sections (194C, 194J, 194I, 192)

- Deduction and deposit of TDS

- Generating Form 16 & 16A

- Filing quarterly TDS returns (Form 24Q, 26Q, 27Q)

- Validating returns using FVU

- Using utilities like RPU and ClearTax

By learning practical TDS return filing, a professional becomes valuable to any business managing payroll, vendor payments, and compliance documentation.

Balance Sheet Preparation – Foundation of Financial Reporting

A balance sheet reflects the true financial position of a business. It shows assets, liabilities, capital, profits, and losses. Preparing an accurate balance sheet requires deep understanding of accounting principles and practical software usage.

What Students Learn in Balance Sheet Training:

- Classification of assets and liabilities

- Period-end adjustments (depreciation, outstanding expenses, prepaid expenses)

- Closing stock valuation

- Finalizing books of accounts

- Generating financial statements in Tally Prime

- Reviewing Profit & Loss statement

Proper balance sheet preparation helps in:

- Loan applications

- Business audits

- Tax filing

- Management decision-making

This makes it one of the most important skills for accountants.

Why Practical Accounting Training is Essential Today

Most businesses prefer hiring candidates who can work independently from day one. Practical accounting training with Tally Prime, GST, TDS, and Balance Sheet preparation gives students the confidence to handle real business tasks.

Benefits of Practical Accounting Training:

- Hands-on work with real business data

- Complete understanding of taxation and compliance

- Increases job opportunities and salary potential

- Helps students start freelance accounting services

- Reduces mistakes in GST and TDS filing

Trained professionals are always in demand in CA firms, industries, corporate offices, and startups.

Who Should Learn These Skills?

This training is ideal for:

- Commerce students (10+2, B.Com, M.Com)

- Graduates looking for job-oriented courses

- Working professionals seeking upskilling

- Business owners managing their own accounts

- Job seekers wanting stable career opportunities

No advanced knowledge is required—only basic computer skills.

Career Opportunities After Learning Tally Prime, GST, TDS & Accounting

Individuals with practical accounting skills can work in roles such as:

- Accountant

- GST Return Filing Executive

- TDS Compliance Officer

- Tally Operator

- Bookkeeper

- Accounts Assistant

- Financial Reporting Executive

The scope is growing rapidly because almost every business—small shop, startup, or company—needs accountants.

Conclusion

Learning Practical Tally Prime, GST Returns, TDS Returns, and Balance Sheet Preparation is one of the most rewarding choices for anyone seeking a career in accounting and taxation. These skills ensure job security, business accuracy, and professional growth. With the right training, students become confident, industry-ready, and capable of handling complete accounting operations independently.

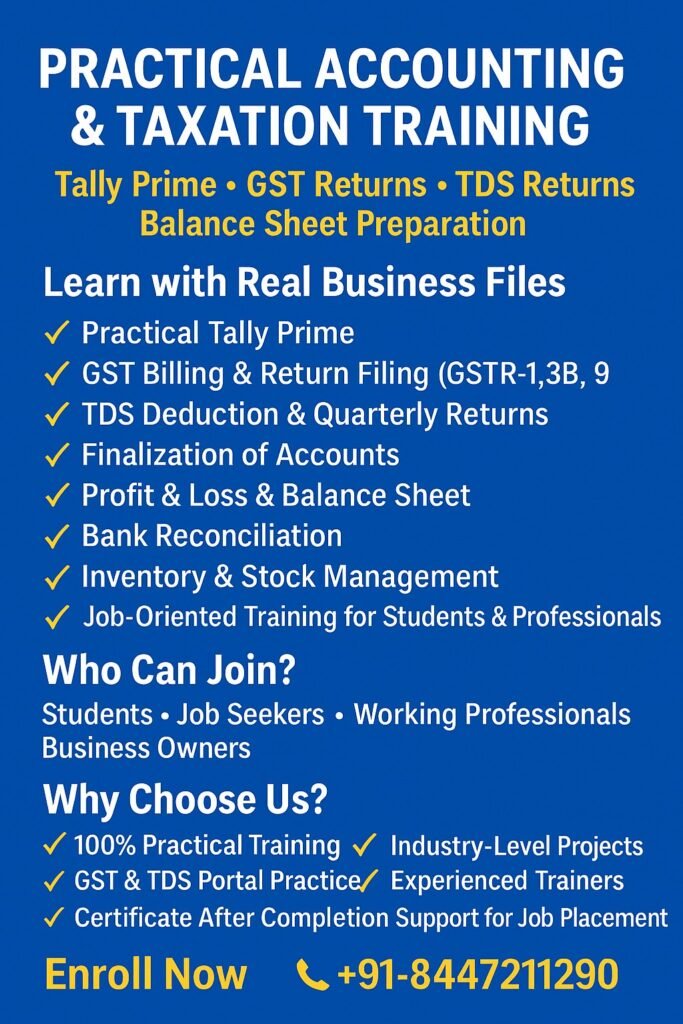

PKR Institute and Recruitment Services LLP

+91-8447211290